For a larger business, we generally recommend more frequent reporting so you can monitor performance and manage cash flow. Monthly COGS reporting gives you the most detailed view of business performance. Cash and credit purchases require a debit to Inventory and a credit to either Cash or Accounts Payable. On April 15, Metro company sells 4 washing machines at $750 per machine. Traditionally, the perpetual inventory system was used by companies that buy and sell easily identifiable inventories such as jewellery, clothing and appliances etc. However, advanced computer software packages have made its use easy for almost all business situations and the companies selling any kind of inventory can now benefit from the system.

The Impact of COGS on Company’s Net Income

Properly managing COGS requires precision and strong cost management skills. It involves careful tracking to help understand business profitability better. Good inventory tracking ensures that no expenses slip through the cracks, as every dollar can affect net income. Knowing this, it’s important that you are confident in your calculations—and that you can perform them quickly when the time comes. If your business is service oriented and does not sell physical goods, you would calculate cost of sales (COS) or cost of revenue (COR) instead of COGS.

Cost of Goods Sold: Definition, Formula, Example, and Analysis

COGS does not include indirect costs such as taxes, shipping, or advertising, whereas COS may include overhead costs such as insurance and rent. This means that the total cost of goods sold figure may be lower than the total cost of service figure. Beyond that, tracking accurate costs of your inventory helps you calculate your true inventory value, or the total dollar value of inventory you have in stock.

How do you calculate cost of goods sold in a service business?

Increase of it are recording debit and decrease of it are record in credit. The contra entry of cost of goods sold is normally the inventory. On the other hand, if the company uses the periodic inventory system, there will be no recording of the $1,000 cost of goods sold immediately after the sale. Hence, the balance of the inventory on the balance sheet will not be updated either as there will be no recording of a $1,000 reduction of inventory balance yet.

- The IRS requires businesses to report COGS, a deductible expense, on their income tax returns.

- These accounting maneuvers ensure that your financial statements accurately depict the value of goods that you’ve sold and correlate with the corresponding decrease in your inventory.

- You can determine net income by subtracting expenses (including COGS) from revenues.

- This process may result in a lower cost of goods sold calculation compared to the LIFO method.

- Navigating tricky COGS scenarios can often feel like untangling a complex web.

Errors here and other failure to comply with IRS regulations can result in penalties and interest. This process is sometimes called “smoothing” because it smoothes the peaks and valleys in demand, allowing the firm to maintain a constant level of output and a stable workforce. These goods are maintained on hand at or near a business’s location so that the firm may meet demand and fulfill its reason for existence. If the firm is a retail establishment, a customer may look elsewhere to have his or her needs satisfied if the firm does not have the required item in stock when the customer arrives.

Is Cost of Goods Sold a Debit or Credit?

The difference is some service companies do not have any goods to sell, nor do they have inventory. Recognition of cost of goods sold and derecognition of finished goods (Inventories) should also be consistent with the recognition of sales. If it is not consistent, then the cost of goods sold and revenues will be recognized in the financial statements in a different period. And it is not in compliance with the matching principle, resulting in the over or understated profit during the period. Below is the explanation of how the cost of goods sold is recorded in the form of double entries in the company management account or financial statements.

The cost at the beginning of production was $100, but inflation caused the price to increase over the next month. By the end of production, the cost to make gold rings is now $150. Using LIFO, the jeweller would list COGS as $150, regardless of the price at the beginning of production. Using this method, the jeweller would report deflated net income costs and a lower ending balance in the inventory.

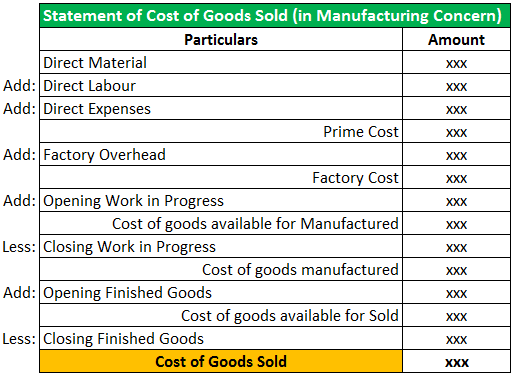

Calculate COGS by adding the cost of inventory at the beginning of the year to purchases made throughout the year. Then, subtract the cost of inventory remaining at the end of the year. how to record cost of goods sold journal entry The final number will be the yearly cost of goods sold for your business. By understanding COGS and the methods of determination, you can make informed decisions about your business.